www.jfmoya.com

OPTION "A" - GENERIC PORTFOLIO

1. The 15 pairs that we base our study on are:

AUD/JPY ; AUD/USD ; CHF/JPY ; EUR/CHF ; EUR/GBP ; EUR/JPY ; EUR/USD ; GBP/CHF ; GBP/JPY ; GBP/USD ; USD/CAD ; USD/CHF ; USD/JPY ; USD/SGD ; NZD/USD.

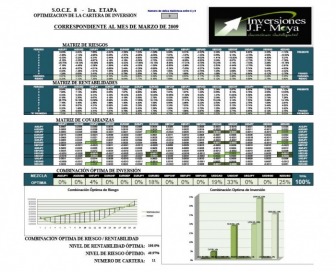

2. In option "A" we firstly obtain every single pair closing data in a month and then we analyze its course based on earlier operated and shown pairs, we work on a careful data processing in order to pass to a second stage that feeds the model S.O.C.E. 8.In order to obtain suitable results, we work monthly, the main reason is because we want to get the monthly pair quotation, so in this way we are able to operate in better conditions, so the investment portfolio that you will get, will last that period.

3. Through S.O.C.E. 8 steps system, that is a succession and combination of studies, we develop the optimal investment portfolio, with 15 pairs. It is considerate a powerful advanced investment system, that adopts brilliant investment models like Markowitz’s in its advanced version, in consideration, we get 20 investment portfolios, each one of them with different risk/profitability combinations and assets; and through a process based on an economical analysis named “Balance Model”, we select one of the combinations to get the most efficient portfolio from which we get the C.O.D.I. (optimal investment combination).

4.- Once you get the optimal investment portfolio and the selected assets among the pairs mentioned before, the only thing that you have to do is adapt the pairs to the investment techniques and estimate the pair’s direction, if it’s “rise” or "fall", the study is useful in this aspect as well, since the Co variances matrix that is present in the same study, and it determinates if a pair has and inverse relation ("X" pair rises while "Y" pair falls) or a direct relation (“X" pair rises and “Y" pair rises as well). In this way you won’t have to worry about stipulating all the directions of the pairs in the FOREX market.

5. - You count on a professional study that helps you in a great way to administrate your investment in FOREX market. This analysis will help you answer the following questions:

- How to diversify my investment of capital?

- Which pairs to invest in?

- How much to invest in each pair?

- What is the portfolio risk that it’s running?

- What is the profitability that can be reached?

These questions are only a few ones that you should know how to answer through advanced calculus before investing your capital.

WE DO IT FOR YOU!

You miss nothing trying our service for free, you can even try it though the simulator gotten with the broker that you prefer.

If your broker doesn’t offer you all the pairs that our study is based on, it doesn’t matter!, you can ask for a personalized study including the pairs that you consider more suitable or that you broker offers you, and we deliver to you something according to your expectations! In that case, is convenient to explore "option B".

.

OPTION "B" - PERSONALIZED PORTFOLIO

1. The 15 pairs that we base our study on are:

AUD/JPY ; AUD/USD ; CHF/JPY ; EUR/CHF ; EUR/GBP ; EUR/JPY ; EUR/USD ; GBP/CHF ; GBP/JPY ; GBP/USD ; USD/CAD ; USD/CHF ; USD/JPY ; USD/SGD ; NZD/USD.

2. In option "B" you are the one who chooses based on your own decision, the pairs that we will base our portfolio study on, in order to get the optimal investment portfolio totally personalized. We firstly obtain every single pair closing data in a month that your company or you told us to, and then we analyze the development based on earlier operations, of every operated and shown pair, we process the data, to be able to pass to a second level that feeds the S.O.C.E. 8 step model.

How do we do this?

We count on professional people with a great experience in FOREX market, data modeler, processing and development in which we base our analysis on in a careful way, the model get different combinations of risk/profitability for each one of the 20 portfolios we create for you before choosing only 1. This only portfolio is gotten through a discarding process based on risk/profitability studies to deliver the optimal investment portfolio among inefficient portfolios that we get. We get the optimal from the efficient!, it means, the best of the best.

We do the 70 % of the process, and 30 % depends on you to reach the success in your operations.

.