www.jfmoya.com

Diversify investment portfolios

Did you know that over 80% of people entering the stock market lose their capital? "The reason is that they do not know how to invest in the stock market". The mistake that is worthy to highlight, is that many investors do know how to determine the correct direction of the market, and they can not diversify their investments, thus putting all their capital in one asset, so it will mean that the portfolio will depend on whether this unique asset agains or losses at the end of the period, is almost like investing blyndly.

JF Moya investment in it’s relationship with the research and investment market systems, design the construction of an optimal portfolios each month to invest in the Forex market, in order to help you through a vast and effective study to decrease the risks of investing in this market through the diversification of portfolio and maximize the benefits at the end of the period.

How we manage this?

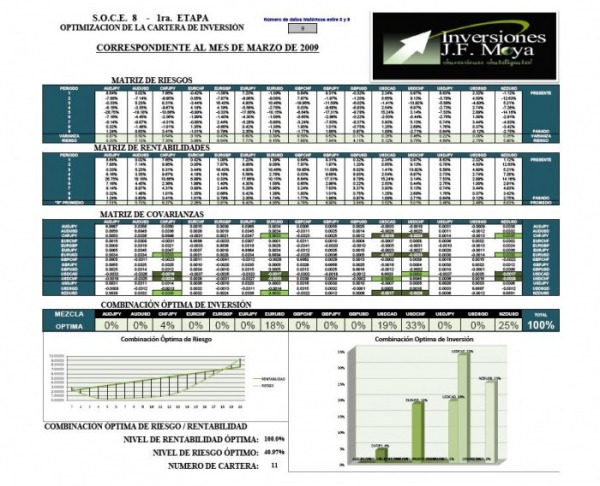

The answer is that we have fully qualified and professional staff that makes a variety of studies in different areas to obtain the optimal investment portfolio, this portfolio is chosen from among several combinations of other portfolios that are efficient, in other words, you get “the best of the most efficient portfolio! For get this, webuild different portfolio options first, that gives us as a result the different combinations of risk / return ratio, is then when we pass these portfolios to a second stage we call “discard”, though our second analysis process, we focus on finding out the inefficient portfolios(the maximum risk incurred is greater the maximum profits), then, we focus on different efficient combinations (the maximum possible benefit is greater than the maximum risk borne), but among all these efficient combinations, we get to a third process called “efficient markets balance analysis ” based on economical, financial, statistical, econometrical studies of several areas; so that in the end, we find the optimal mix of investment!!.

Vital and qualitative information- the best of the most efficient- is what we deliver to the professional investor, to our customers.

Your benefit, ¡our benefit!

It is extremely important to us that you get positive results, because if you get good results using portfolios that we deliver to you, and then we are doing well, a satisfied customer is our biggest reward, because it means that our work is truly efficient. We want you to understand that the stock market can not be totally related to “mathematics” , the reason is that there is no way to know how too many people will react day by day neither the reaction of an active investment, there may be a market volatility, high volatility or financial market crisis, that makes the environment very difficult to estimate, then comes up the need of a diversified portfolio management, the portfolio risk is possible to calculate, especially the risk that can run an investment portfolio, same as the benefits that we can reach at the end of a period, an accurate quantification of risk and benefit we can get, let us plan the way we to invest our capital, thereby the chances of success increase.

We do not offer a “robot program”, that will assure you success in your investments, there is no such thing, we offer you to increase your chances of success substantially by diversifying a portfolio, and teaching you how to manage the combination risk / return ratio properly, and that is the real reason of the existence of our company.

Do not put all your faith and effort in a single asset, different process and diversification studies help us to reduce investment risks and maximize benefits, greatly increasing the odds in your favor. The risk can not be completely eliminated, but can be control it. The appropriate way to manage an investment portfolio is to select asset-dependent zero or near zero, this means that no matter what happens to an asset portfolio, it will not necessarily happen to the other, they have no real connection, but if you place the capital assets in high-dependency then what happens to one is reflected in the other and risk will increase instead of decreasing.

Diversification is equivalent to saying: “Do not put all eggs in the same basket.”

This process allows us to.: 1.. Maximize benefits by exploiting market conditions. 2. It helps us to protect our portfolio against risk trends and changes in the economy.

Studies of diversification of investment portfolios are the best kept secrets of great investors, corporations and financial institutions; we do this type of study that allows you to put yourself among 20% of investors who earn, compared with 80% of people who lose their capital due to bad decisions because of lack of information.

So take advantage now!, If you’re reading this, you are in the right place and is your opportunity to increase revenues and control the risk ¡! We are professionals working in several areas to get more efficiency and knowledge and we work for you in order to make you get advantage over other investors. It is only a chance of getting the odds in your favor, subscribe to our service, we will gladly provide the information you need before making your investments.

Do not invest blindly, make smart investments!!.

.

Example of presentation of the final outcome of the portfolio.

Make the right decision, you deserve an investment that can be optimal, safe and reliable, by intensive, highly efficient and effective study to enable you to make the best decision for entry and exit, and having the first line information that allows you to minimize porfolio risk and maximize the profits.

Any questions please contact us in the shortest possible time to answer your questions and doubts.